Starlink Is Now Starting To Make Money

After years of launching and thousands of satellites now in orbit, Starlink has achieved breakeven cash flow. In the past, they met this milestone relative to satellite-specific costs and revenue while not including the cost of launching the hardware. This time, even with the cost of practically constant Falcon 9 missions, they are making enough revenue to offset these expenses.

This is big news for the company as they only plan to grow from here with tens of thousands of satellites still set to launch in the future. Combine this with continued work on Starship, SpaceX’s next-generation launch vehicle capable of launching hundreds of Starlink satellites at a time, and we could start to see a serious increase in coverage. Here I will go more in-depth into the finances of Starlink, the cadence of launches, plans for the future, and more.

Breakeven Cash Flow

A few days ago on November 2nd, Elon Musk tweeted saying, “Excited to announce that @SpaceX @Starlink has achieved breakeven cash flow! Excellent work by a great team. Starlink is also now a majority of all active satellites and will have launched a majority of all satellites cumulatively from Earth by next year.” In this case, when he mentions they achieved breakeven cash flow, that’s the point where your operating cash inflows match your operating cash outflows. In other words, at this point, the company is no longer losing money and has the opportunity to start turning a profit.

Earlier this year in February, SpaceX had launched more than 3,500 satellites in total to create a global broadband network, with the service reaching 1 million subscribers last December. Around that time period, SpaceX President Gwynne Shotwell was quoted saying, “This year, Starlink will make money. We actually had a cash flow positive quarter last year.” This year, they’re paying for their own launches, and they will still make money” she said. This means that around last year Starlink had managed to generate enough revenue to cover practically all of its expenses with the exception of launching the hardware. This obviously is one of the most expensive aspects of a satellite business but something that SpaceX has an advantage on.

Now, however, including the cost of a Falcon 9 launch every few days, they have still managed to reach breakeven cash flow. One of the reasons this is so important is because Starlink is meant to be the cash cow for SpaceX and a lot of its future endeavors. SpaceX’s current valuation is estimated to be around $150 billion, with Starlink as its backbone. A few years ago, Musk emphasized that making Starlink “financially viable” required crossing “through a deep chasm of negative cash flow.”

Early this year, when asked about SpaceX’s plans to IPO its Starlink business, Shotwell said there is “no update.” Last year, it was reported that Musk told employees that the company isn’t likely to take Starlink public until 2025 or later. This joins a host of times that Musk has mentioned the idea of making Starlink public. “Being public is definitely an invitation to pain,” Musk told SpaceX employees in 2022. “And the stock price is just distracting,” he said. In reality, with current funding already plenty high and the long list of downsides of going public, we likely won’t see Starlink go public for a very long time.

By now, SpaceX now has more than 5,000 Starlink satellites in orbit, according to a letter to the FAA from the company. Nearly 12,000 satellites are planned to be deployed, with a possible later extension to 42,000. For the past few years, the SpaceX satellite development facility in Redmond, Washington, has housed the Starlink research, development, manufacturing and orbit control facilities. In May 2018, SpaceX estimated the cost of designing, building and deploy the constellation was estimated to be at least US$10 billion. By January 2017 SpaceX expected more than $30 billion in revenue by 2025 from its satellite constellation, while revenues from its launch business were expected to reach $5 billion in the same year. While the company hasn’t quite reached its initial estimates, the service has been growing significantly. This is mainly thanks to the improvements to the Falcon 9 and an increase in launch cadence that’s never quite been seen before within the space industry.

Constant Launches

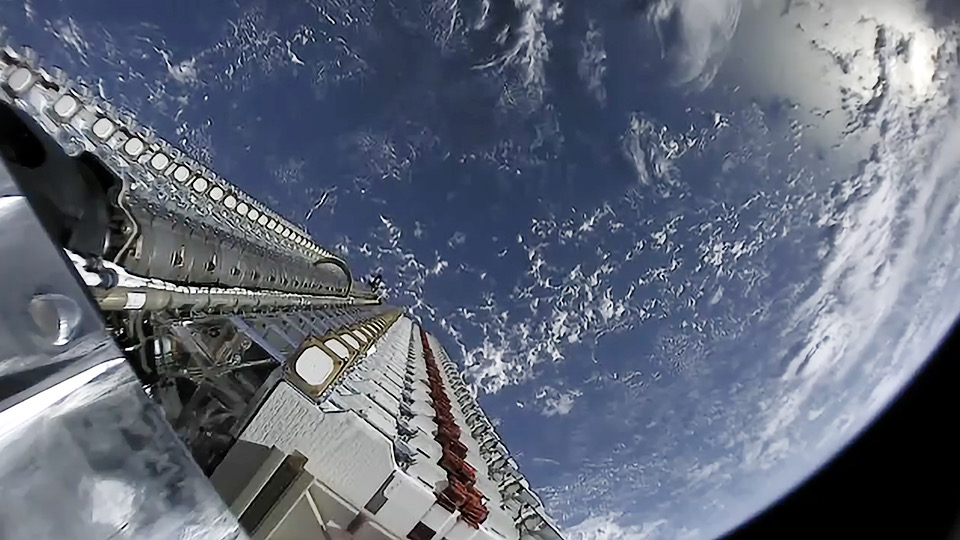

It’s important to point out that the number of Starlink satellites in low Earth orbit has a big impact on both the service’s coverage and speed. As more satellites reach orbit and more ground stations are built, Starlink users will likely see improved download speeds and lower latency. With this in mind, the obvious challenge becomes launching tens of thousands of satellites in total, when you can only launch around 20 at a time.

As partially mentioned before, SpaceX has the major advantage of using its own rockets to launch satellites. Arguably even more important than that is the partial reusability of these systems saving money and most valuably time. Back in September, SpaceX completed its 61st launch this year. That also marked the number of launches SpaceX completed in the entirety of 2022, which was a record in itself. Around that same time, Elon Musk tweeted saying, “Great work by the @SpaceX team successfully launching 61 Falcon rocket missions this year! If tomorrow’s mission goes well, we will exceed last year’s flight count. SpaceX has delivered ~80% of all Earth payload mass to orbit in 2023. China is ~10% & rest of world other ~10%.”

Interestingly, SpaceX hasn’t been launching just to launch, but has either filled the Falcon 9 with commercial payloads or Starlink satellites. Starlink provided the extra demand necessary to literally always have a payload available so long as the rocket is ready. To add to this, in another tweet Elon pointed out, “Aiming for 10 Falcon flights in a month by end of this year, then 12 per month next year.” This tweet is actually a very big deal. So far this year SpaceX has averaged around 7.6 launches a month or one every 4 days. At the new rate, SpaceX would be launching around 144 times a year. This is technically possible, but it comes with its own challenges.

Just yesterday the company broke its record for Booster reuse by launching and landing a booster for the 18th time. Of the 18 missions this booster had been a part of, 12 of them were Starlink missions. This amount of reuse and cadence is getting to the point where SpaceX might need to upgrade its landing infrastructure. SpaceX has three operational drone ships. Of Course I Still Love You is based at the Port of Long Beach to support West Coast launches from Vandenberg. Just Read The Instructions is based at Port Canaveral and began operations in the Atlantic in June 2020. Finally, A Shortfall of Gravitas is based at Port Canaveral to support east coast recovery operations. In relation to this, SpaceX launches from three different sites, two on the East Coast and one on the West Coast.

On average, it takes about a week for the drone ships to land a booster at sea, return to land, drop off the booster, and return to position for another launch. With only three drone ships this conflicts a bit with the launch frequency that SpaceX will attempt to meet. This being said, SpaceX doesn’t need to land boosters on drone ships. In order to meet this frequency goal, we will likely see more Falcon boosters return to the launch site for a landing on the ground. A mix of these landing profiles with the drone ships could support a launch every 2.5 days. Something the company might implement depending on how future launches go.

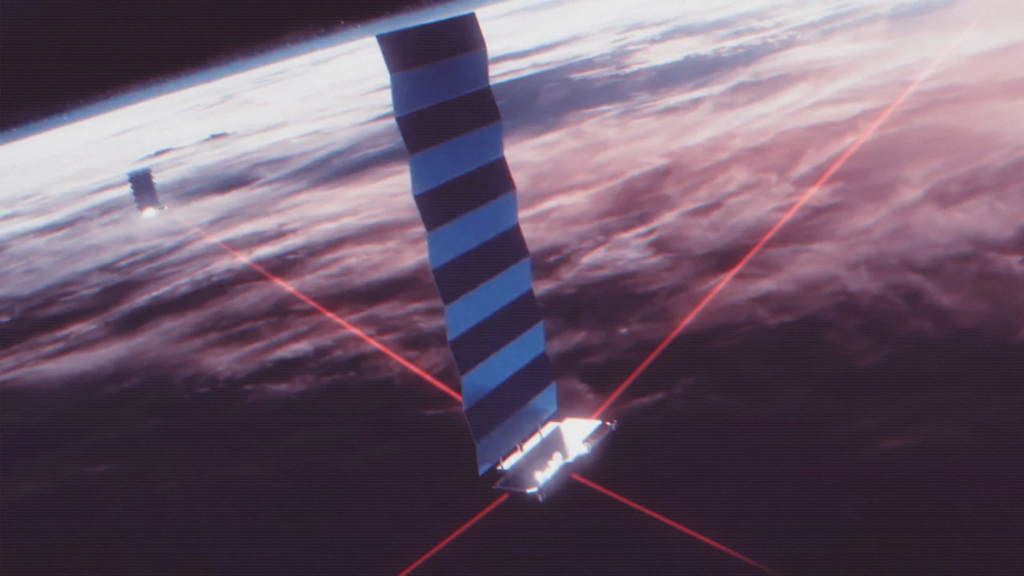

Focusing back on Starlink, back in March of this year, the company reported that they were manufacturing six Starlink “V2 Mini” satellites per day as well as thousands of user terminals. The V2 Mini has Gen2 Starlink satellite features while being assembled in a smaller form factor than the larger Gen2 sats. Right now, SpaceX is launching around 20 of these Starlink satellites per Falcon 9 launch. If this vehicle alone were to be responsible for the rest of the constellation, it would require another 1,800 or so launches of the Falcon 9. In addition, the Gen2 satellites require the 9-meter-diameter Starship in order to launch them. Basically, all roads with Starlink lead to eventual deployment and integration on the Starship launch vehicle. This being said, it will take time before Starship is launching consistently and deploying satellites.

On the bright side, this rocket is making progress and could be just weeks away from its second test integrated test flight. The company just confirmed that the second flight test of a fully integrated Starship could launch as soon as mid-November, pending regulatory approval. On the first launch, during ascent, the vehicle sustained fires from leaking propellant in the aft end of the Super Heavy booster, which eventually severed connection with the vehicle’s primary flight computer. This led to a loss of communications to the majority of booster engines and, ultimately, control of the vehicle. The company has since implemented leak mitigations and improved testing on both engine and booster hardware. As an additional corrective action, SpaceX has significantly expanded Super Heavy’s pre-existing fire suppression system in order to mitigate against future engine bay fires. Now SpaceX has an upgraded Starship rocket back on the pad ready for approval. Once this vehicle is up and running, it’s expected to completely change the Starlink service and what it can provide.

Conclusion

After many years of development and launches, Starlink now has over 5,000 satellites in orbit and has managed to reach breakeven cash flow. This is mainly thanks to the Falcon 9 which launches every few days. We will have to wait and see how it progresses and the impact it has on the space industry.